Real Estate Projects For Hedge Funds

Why Investing in Real Estate Projects for Rental Often Leads to Better Profits

Solid real estate projects developed specifically for rental are one of the best non-liquid assets to add to an investment portfolio. Hedge funds have dominated the stock market, played with the bond market, dabbled in commercial real estate, and even tried out farmlands. Is real estate rentals the next market ripe for investment?

Why is buying and renting out multiples of single-family homes transforming the property market today? And how are hedge funds driving this new investment strategy?

What’s Happening in the US Housing Market Today

Whilst the main buying strategy of the smaller individual investor has long been purchasing quality single-family homes for the purpose of rental, this same strategy is rapidly becoming the investment of choice for many hedge fund managers and institutional buyers.

As many ordinary people are still reeling from the market crash of 2008, they have chosen to rent instead of buying their homes. What was once the last hurdle of investment freedom for many individuals, buying a house is now seen as a risk many fledgling financially savvy folks are no longer prepared to take.

Hedge fund managers and institutional buyers have been quick to step into the gap this homeownership reluctance has created.

The Reasons for the High Real Estate Rental Demand

In recent years the advantages of renting a home, instead of buying one, have become ever more apparent. With students, retirees, singles, and single-parent families now choosing to lease a home, the demand for rental apartments and houses has never been higher.

In 2016, approximately 37% of Americans chose to rent their home. Renting is seen by this percentage as an affordable alternative to buying a home. This preference has been driven by the downward trend in the cost for rental properties across the board.

Rental vacancy rates decreased from about 40% in 2009 to slightly over 25% in 2016. This reflected the increasing demand for affordable rental homes in the US. The reason for this upswing has been driven by developers focusing their attention on luxury unit construction meaning fewer mainstream houses were built as a consequence.

The majority of renters in America live in standard single-family homes. At the end of 2016, half the residents of these rental properties were under the age of 30 years old; this indicates the shift in buying trends displayed by the Millennial generation.

These facts are proof that the need for moderate family or young couple purpose-built housing will continue to rise. As an investment, bulk buying real estate properties for rental provides a steady revenue stream as well as being a beneficial asset.

Some Mergers that Further Indicate the Rental Property Investment Trend

In August 2017 Invitation Homes, owned by private equity behemoth the Blackstone Group, and Starwood Waypoint Homes (which bought Colony American Homes in 2014), owned by the real estate property giant Starwood Capital, merged to form an entity with a single-family rental homes portfolio worth over 20 billion dollars.

Going back four years, in July 2014 the Beazer Pre-Owned Rental Homes company was bought by American Home 4 Rent. This cemented the creation of an enormous player in the rental real estate market.

Besides the merging of the Titans in the above examples, there are a few medium-tier players that are entering the market too. In 2017 around 2,000 rental homes were snapped up in Texas by a hedge fund manager. The reason for the steady acquisition was easily explained.

- There are lots of small investors assembling real estate rental portfolios of 10 to 100 homes.

- These small property portfolios are then bought up by medium-size hedge fund managers.

- The medium-size property portfolios then get bought out by mega-players like the Blackstone Group.

This upward momentum is fed by an unlimited pool of potential home renters.

Significant Opportunity for Hedge Fund Managers & Institutional Buyers

There are over 17 million rental homes currently in the United States: ample proof that the mega-funds have not managed to gobble up the majority of the market.

The one thing that works against the consolidated giants is that they simply cannot buy up properties for rent one at a time – they have to buy in enormous bulk – and are prepared to pay a premium for this.

That is where the opportunity lies for the medium-size fund manager. It is easy to assemble a large property portfolio with the sole intent of selling it to a mega-fund further down the line.

Even the medium-size institution buyer does not have the extra time to vet every property for acquisition. This is where the smaller investor can play the game as well.

Individual investors, who want to get in on the real estate rental investment at the ground floor, can start with as few as ten hand-picked properties, and flip them to a medium-size fund when they need to buy in bulk themselves.

In fact, the smaller investor can make an even quicker flip once they have the necessary contacts with the medium-size funds. They could, in theory, make the arrangements to hand over their rental property package when the single-family homes are still under contract and there is only a small deposit on each home.

Before they close, the package is flipped to the medium-size fund through a double-escrow deal. The structure of this kind of closing guarantees a tidy profit to the small investor and requires a limited amount of up-front capital.

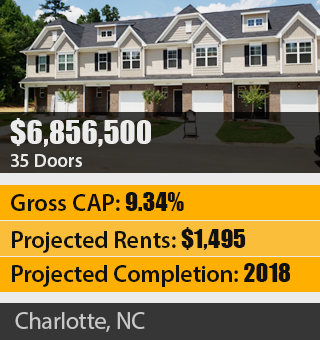

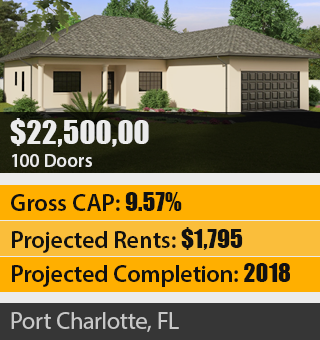

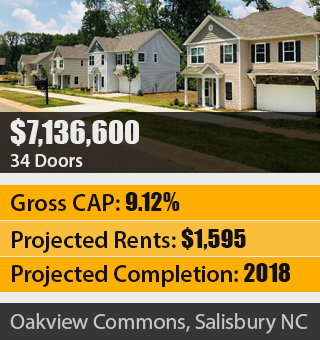

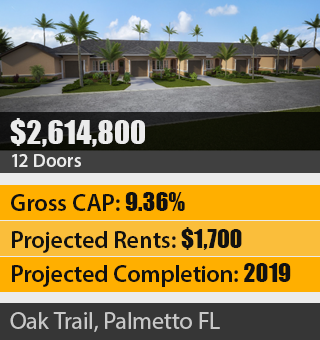

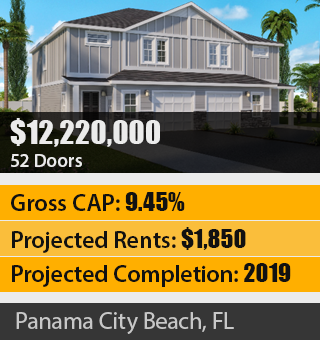

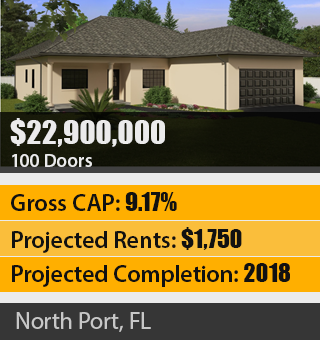

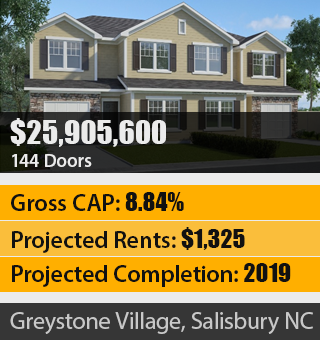

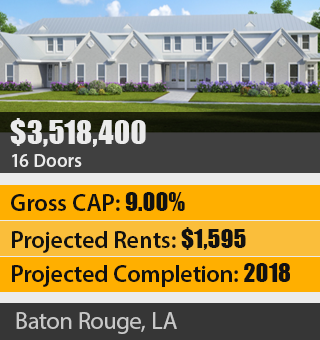

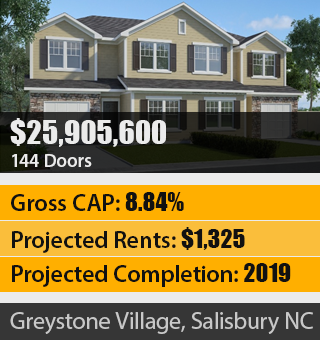

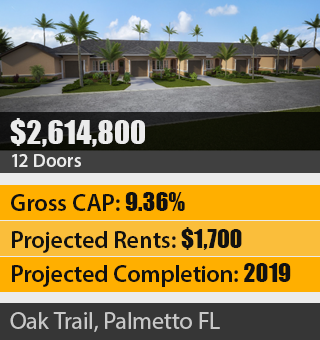

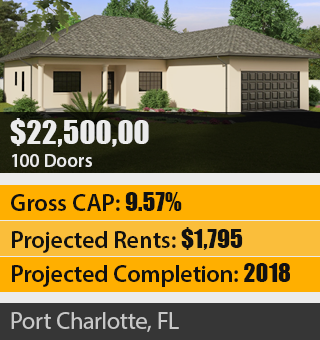

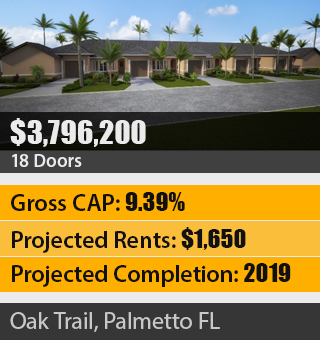

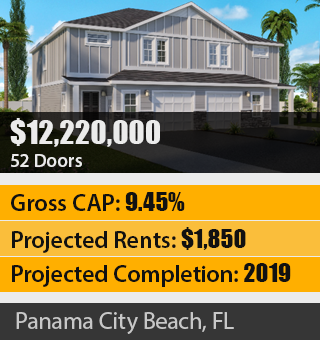

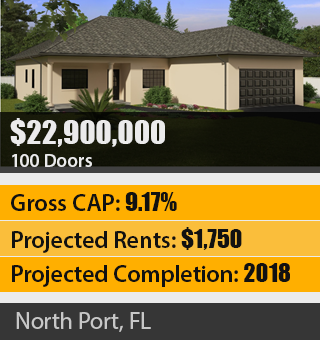

Along similar lines the opportunity to pre-sell properties, particularly new construction, to hedge funds has given rise to another huge industry termed Build-For-Rent ‘BFR’. This market has come about solely because hedge funds have too much capital to place and there are insufficient completed homes to consume that capital.

As such, hedge funds are now actively entering into pre-construction contracts with developers and builders on the basis they will close on the purchase as soon as the homes are complete. Typically, these contracts can be anywhere from 50 up to 300 more homes comprised of SFRs and multifamily dwellings.

Why Single-Family Rentals are Highly Desirable Investments for Funds

Single-family rentals do not just provide a strong hedge against inflation; they have limited correlation to more volatile, yet widely held investment assets such as commercial real estate, stock, and bonds. They are, however, positively correlated to inflation; meaning if erosion occurs in other sections of a well-diversified portfolio, single-family properties will provide a good hedge against valuation drops.

These are the many salient reasons why the frontier of real estate rental is ripe and ready for exploration by the clued-in fund overseer.