Zillow Scores a Zero for Consumers & Realtors

December 20, 2019Suburbs vs. Cities Post-Covid 19

June 26, 2020Will the Coronavirus Impact

the Real Estate Market in the US?

Will there be a coronavirus ripple effect on real estate in the U.S.? That’s what we’re here to find out. This article will deal in facts, and not be influenced by the fairly hysterical media reaction caused by slow news days and the need for click-bait headlines.

Image credit: Signazon.com

It has been said that when China sneezes, the world economy better reach for a handkerchief. But will that knee-jerk, domino effect have the power to lower housing prices in the States?

China Lurches from the Trade War to the Coronavirus

China is still recovering from the tariffs imposed on Chinese imports into the United States. Now, the country’s industrial output and manufacturing concerns have been severely curtailed by the curfews and sanctions imposed by a government that wishes to appear hyper-proactive towards the virus on the world stage.

The predicted inflation caused by the tariff increase was camouflaged by the general rise in cost of living expenses across the board. Most importers continue to use China as their preferred supplier, as it is simply easier than shopping around for a new deal. If anyone was motivated by the tariffs to find a new supplier, the chances are very high that one of China’s neighbors – or Mexico – would benefit from being the recipient of the contract.

Although the trade deficit fell by $10.9 billion for goods and services in 2019, in the wake of the biggest U.S. economic offensive seen in recent years, this was largely due to a cooling down of the global economy in general.

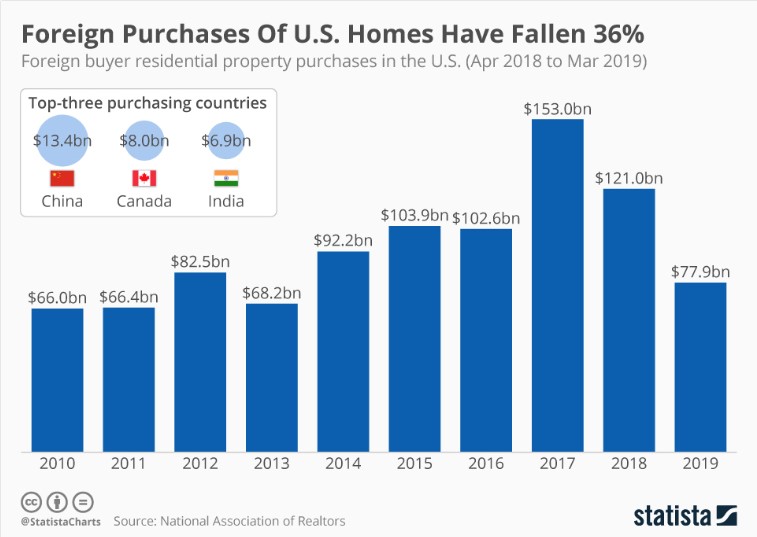

Is the Coronavirus Likely to Effect Chinese Buying Real Estate in the United States?

With all the forms of digital communication at our fingertips, it is unlikely that being housebound or travel-restricted will be enough to diminish the Chinese fondness for investing in real estate in the United States.

Figures show that by the second quarter of 2019, the Chinese had purchased more residential real estate in the U.S. than buyers from any other country, including Canada. However, statistics on average show a decline overall when compared to those of previous years. This slowing down could be linked to punitive actions on behalf of the Chinese government as fallout from the height of the Trade Wars in June, 2019, last year. It could also be indicative of the cooling global economy.

How the trade war and Chinese purchases of U.S. residential real estate had no effect on house market can be read about in our previous blog.

Image credit: Statista.com

Is the Real Estate Market Linked to the Stock Market?

The stock market reacts to domestic and foreign influences, but the most significant factors when it comes to post-2008 house prices and activities are listed below.

- Confidence and trust returns to buyers

- Job creation grows

- Borrowing rates remain attractive

- The economy remains stable

- Government policies stay favorable towards the home buyer

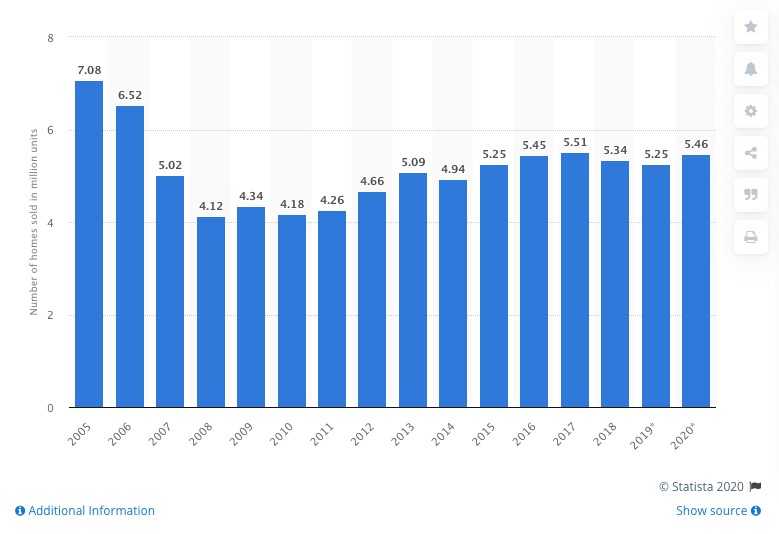

From the over-inflated artificial highs of a pre-2008 residential real estate market, through to the recovery and gradual increase, the chart below indicates how the housing market has recovered and stabilized.

Image credit: https://www.statista.com/statistics/226144/us-existing-home-sales/

These figures show a healthy median average of residential properties are sold in the United States every year regardless of outside influences and current events.

Compare this chart of United States stocks and shares prices from 2011 – 2020 below. You can see at a glance that the two charts look nothing like each other. So, all the reports proclaiming that because the stock market has been quick to react to the outbreak and spread of the coronavirus, the United States residency real estate market will follow, are not based in fact, proof, or statistics.

Image credit: data.OECD.org

Some of the Facts Home Buyers Should Keep in Mind About the Coronavirus

1. Contagious diseases have always been contained

Thinking back to the SARS outbreak in 2003-2004, the MERS outbreak before that, and the more recent Ebola scare, all three contagions were successfully contained before they could have had a significant impact on the world economy and the financial markets. That is the course most medical and epidemiological forecasters predict the coronavirus will take.

Knowing that past outbreaks have always been contained is more than enough to counteract the media hysteria.

2. The economy of only a small part of China has been put on hold

Only the cities near Wuhan in the Hubei province have been effected by the shutdown. That’s approximately 60 million workers or people out of an estimated 1.4 billion.

3. The breakout happened at a beneficial time for the U.S.

The Chinese economy was already winding down at the time of the outbreak because of Chinese New Year celebrations. If the Chinese economy is further weakened by its continued suspension, it can only lead to Premier Xi Jinping making further concessions with President Trump in their trade agreements.

With the Chinese premier in a more conciliatory mood because of the spread of the virus, this means any trade agreement made in the future will be in favor of the United States.

4. The public is more aware of containment protocol and wise to the fact that the media is over-reacting

The media echo-chamber is no longer as effective in exaggerating the facts and having them believed. Additionally, the public themselves, and public health and safety sectors, are more vigilant now than during previous outbreaks.

The Fed Has Been Told to Be a Leader, Not a Follower

The president has criticized the Fed for not slashing bank rates more aggressively, as most other countries have done. The expected lowered borrowing costs in lieu of this announcement will not only stimulate the economy, but the real estate market will remain buoyant with lower bank rates as well.

With elections just around the corner, you can be sure that everything will be done to keep the electorate in a positive mood. This is why favorable borrowing rates is only one of the things we can expect to stay supportive of the residential real estate market.

Drugs to Treat Coronavirus Patients are Coming

A vaccine for the novel coronavirus may not be on the horizon, but drugs that will effectively treat infected patients is closer than we realize. These medications will be easier to implement instead of waiting for a vaccine to be approved. This means that, although the coronavirus will still be around, it won’t be deadly to anyone with access to the drugs to treat it.

Conclusion:

With all of the facts in front of us, we can conclude the residential real estate market in the U.S. will not be effected by the coronavirus outbreak. The only mini-slump will be felt by the commercial real estate sectors dealing in the hospitality industries.

Image embed:

https://www.statista.com/chart/18938/foreign-buyer-residential-property-purchases-in-the-us/

https://www.nytimes.com/2020/02/05/business/economy/trump-trade.html

https://www.nytimes.com/2020/02/29/business/economy/coronavirus-central-banks-economy.html

https://www.cpexecutive.com/post/how-will-coronavirus-impact-us-commercial-real-estate-sector/