Why Real Estate is a Safer Investment Than the Stock Market

Congratulations visiting this page.There are now many people questioning the wisdom of a long term investment into the stock market.

In recent years, investors have turned to the stock market as the traditional place for investment. Traditionally people with spare cash want to grow it into a nest egg and therefore prefer stock options and shares over any other savings scheme.

And while the stock market is a well-known investment option, still not every person understands that buying real estate is considered to be a viable and often better alternative. Real estate offers the investor a lower risk, greater diversification and also yields better returns under the right circumstances.

Whether you want your investment as a way to plan your retirement, save for a college fund, or earn residual income, you need the right investment strategy to fit your needs and your budget.

Real Estate vs. Stocks – Apples and Oranges

Let’s start by comparing the two forms of investment side by side; but first a few key takeaways on the real estate vs. stock market debate:

- The stock market is linked to economic, market, and inflationary risks. However, they don’t ask for a huge cash injection to get started, and generally speaking, are easily bought and sold.

- Any decision to invest to stocks or real estate is your personal choice, dependent on your risk tolerance, investment goals and style and pocketbook.

- Real estate is not as liquid as stocks. Also, investing in real estate requires a certain amount of expertise plus money, time, and research. On the big plus side, real estate provides you and your family with a passive income stream as well as the potential for more than substantial appreciation.

- Both stocks and real estate offer different opportunities and risks.

Stocks

It’s safe to say that more folks invest in stocks because it doesn’t take as much money or time to do it. Alternately, if you’re buying real estate you have to save in order to be able to put down a large deposit.

Psychologically, it can be very rewarding to buy stocks – it means you own a tiny piece of the company. Stocks make money for you in two ways:

- Your investment goes up in value when the company’s stock increases

- You can receive regular dividends – depending on the company – and you can reinvest these

Real estate is when someone acquires physical property or land. Any canny real estate investor buys property to make money from rent. This is what provides the property owner with a steady income stream. Land or property makes money for you in two ways in addition to this:

- As the property’s value goes up, so does the rental fee. Land appreciates in value as they aren’t making any more of it, especially in highly sought after locations.

- Real estate can be leveraged, so it’s possible for you to expand your holdings if you can’t afford to put down cash outright (and leverage is recommended by the way).

Real estate is an appealing investment for many prospective HNWIs and also anyone thinking about long term investment opportunities, because it’s a controllable, tangible asset.

Returns of Real Estate vs. Stock Market

Investing in the stock market can be highly unpredictable, even at the best of times. The ROI is also often lower than expected. The factors that affect valuations, prices, and returns are very distinct to the stock market.

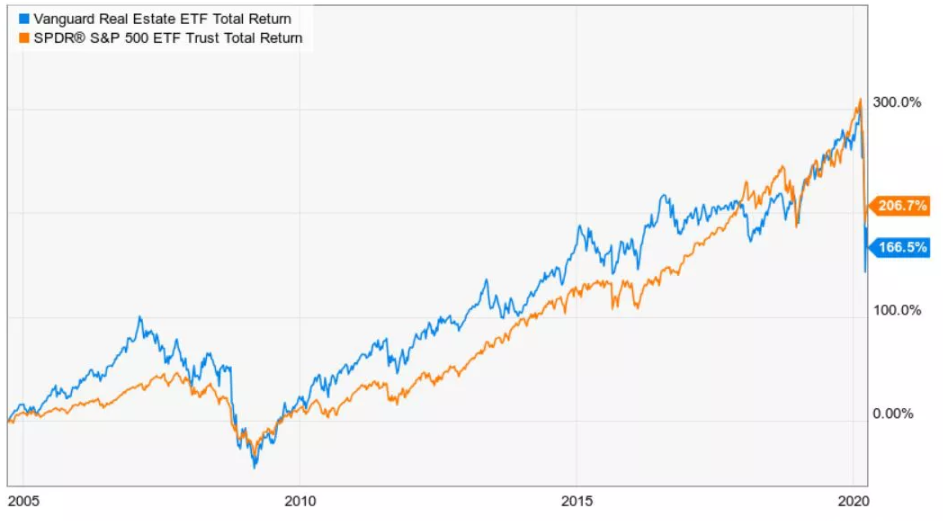

Both the stock market and the housing market gets hit during times of recession. As you can see in the chart, there are significant dips during the 2008 great recession and the markets are also reflecting the current crisis with the Covid-19 panic.

It’s important to know that real estate and stocks each have very different risks in general.

Pros and Cons of Real Estate Investment

Real estate is a less volatile investment. It offers passive income and long term cash flow even during harder, more financially unpredictable times. That sits in direct opposition to the stress of investing in stocks and shares. In the last month as the economic impact of the Virus has unraveled, investors in real estate (particularity SFR rentals) have been calm compared to the stress-state for Stock Market investors.

This is because real estate investors have the benefit of gaining leverage on their capital. They can also take advantage of the substantial tax gains it offers. Okay, real estate is not as liquid as stocks but the long term passive income cash flow it provides, in addition to the promise of appreciation, is immense.

Credit: Investopedia

Despite all of these benefits, the amount of money that gets tied up in a real estate investment can be daunting. That’s why most real estate investors prefer to hand over the heavy lifting, such as researching desirable properties for purchase, landlord duties and property management, to an expert.

Pros | Cons |

· Permanent, passive income · Tax advantages · Ability to leverage · Excellent hedge against inflation | · More work than buying stocks and best handled by a professional to guide you in the beginning · Not liquid · Guidance needed to avoid higher transaction costs |

Pros and Cons of the Stock Market

Stocks are more volatile than real estate and this is why they are considered by many to be the more risky investment. If you decide to sell your stocks, it can result in incurring capital gains taxation. Unfortunately, unless you have a considerable amount of your money tied up in the stock market, your holdings won’t be adequate in providing you with a comfortable retirement – they don’t grow enough to generate a satisfactory income.

Pros | Cons |

· Liquid · Easy to diversify · Less money required to get into | · More volatile than real estate investments · Can trigger big taxes when you sell · Difficult to learn how to master · Stocks can lay dormant for years · It is far easier to emotionally manipulate someone with stocks · Intangible |

The takeaway from this has to be that purchasing property allows investors to have more control over their money and it also enables them to buy more valuable investments further down the line. The cash harvested from rentals can cover the mortgage repayments, insurance, repairs and property taxes. A well-managed property generates substantial income for its owner/s and additional beneficial investments in real estate include tax write-offs, such as depreciation costs (when interest rates are low as they are currently, leveraged ROIs for new SFRs frequently range 10-12% apr + capital appreciation).

Even in rent controlled areas, real estate continues to generate monthly income. Real estate capital gains (depending on your overall income) can be deferred if you purchase another property after the sale.

Investing in the real estate market is the perfect way to reduce risks, diversify your investment portfolio and maximize returns. It’s often seen as a safer form of investment because – unlike stocks – you can’t just snap your fingers and have property and land disappear.

If you would like to know more about how you can start your journey up the property investment ladders, make an enquiry today to learn how we can turn your money into hard working cash.